direct vs indirect cash flow forecasting

Indirect Cash Flow Forecasting You can perform a cash flow forecasting using either the direct or indirect method. Learn the differences between direct and indirect cash flow forecasting.

The direct method ideal for shorter periods.

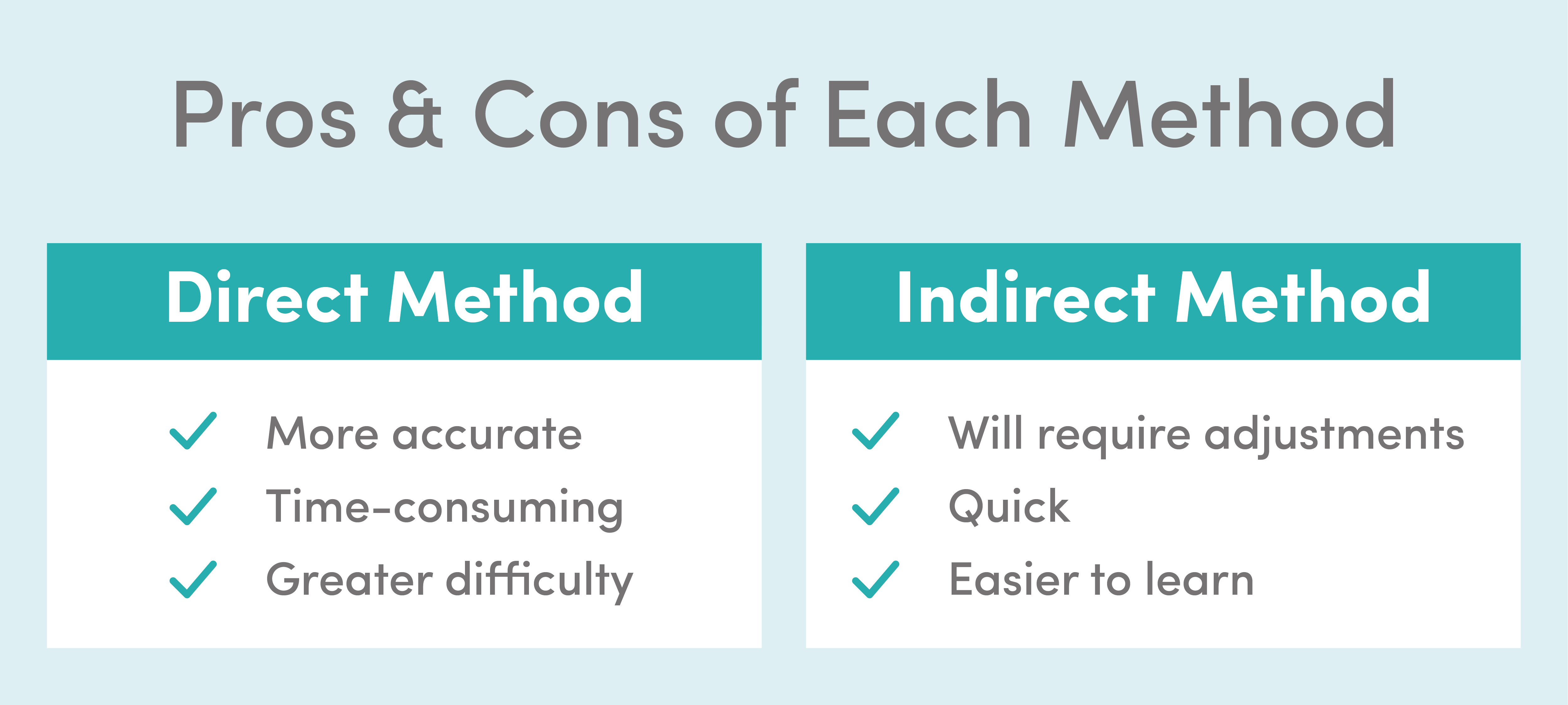

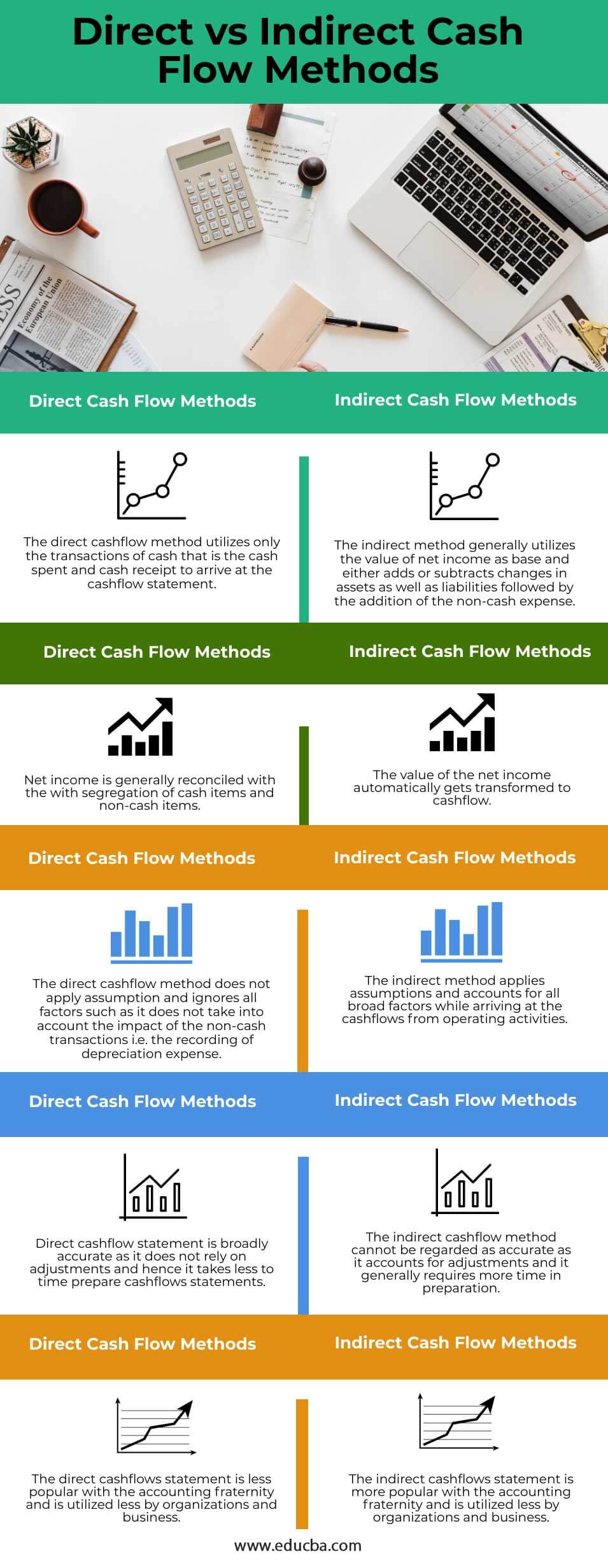

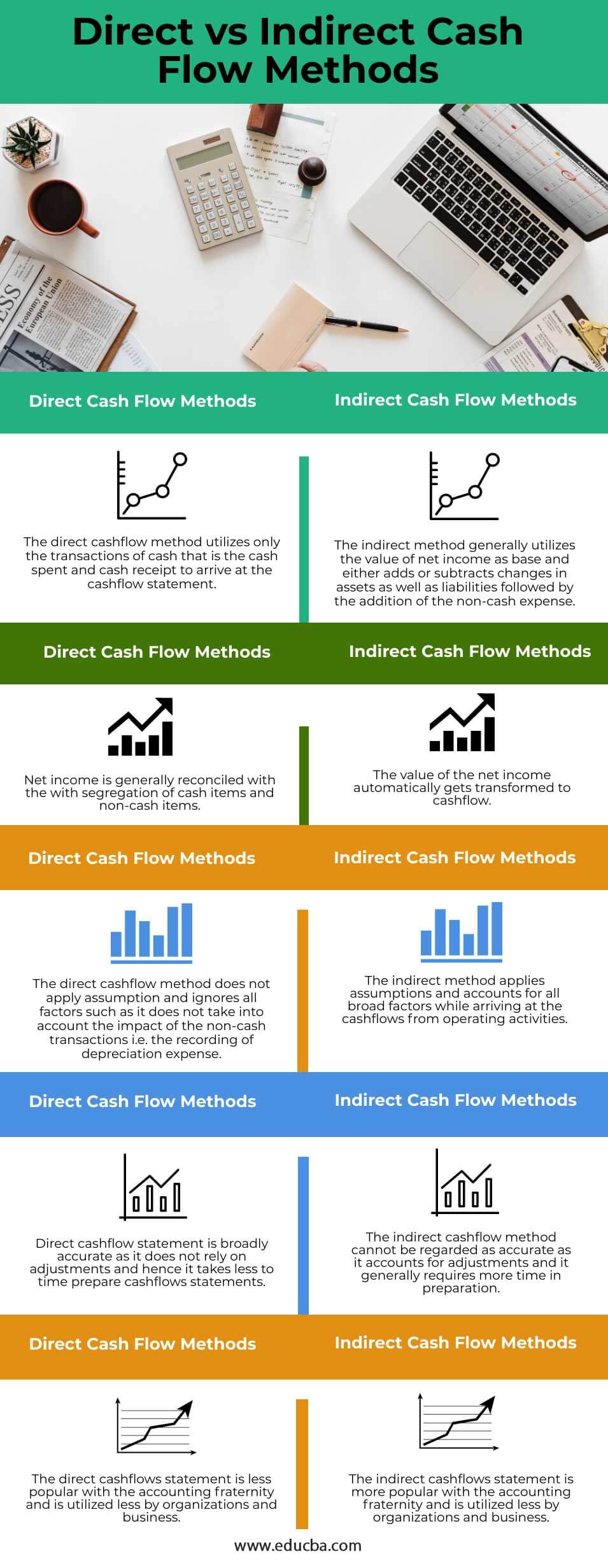

. The direct method includes all types of transactions including credit and cash transactions as well as bills invoices and tax. The indirect method is relatively complex method as compared to the direct method as it utilizes. So whats the difference between direct and indirect.

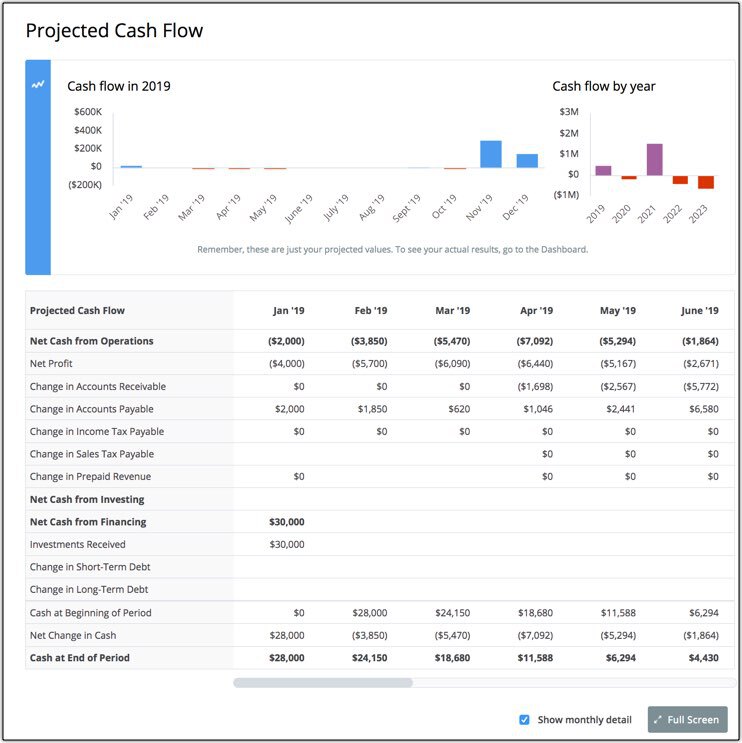

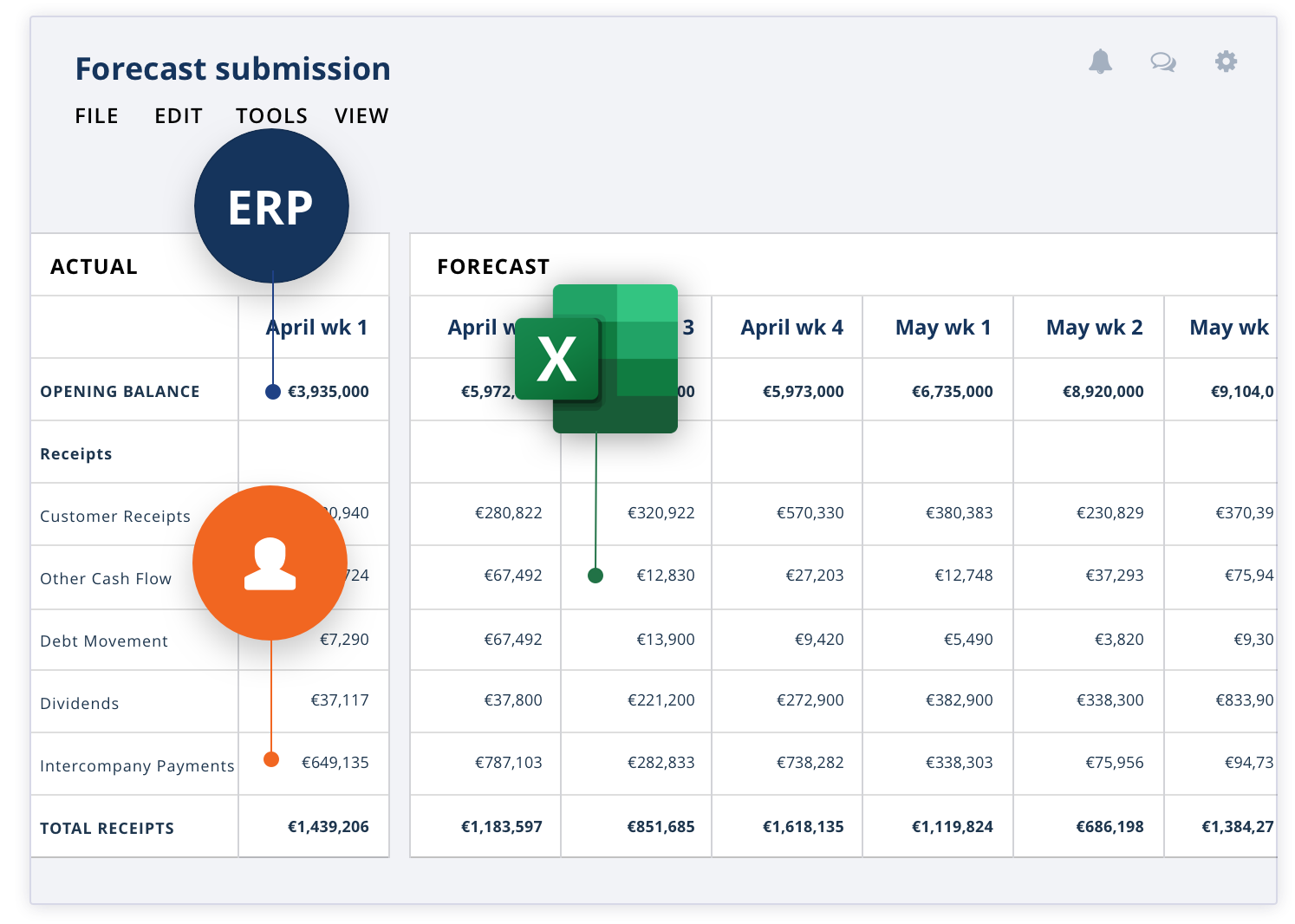

The near-term forecasting is known as direct forecasting while the longer-term forecasting is known as indirect forecasting. Direct forecasting can be quite accurate while indirect forecasting yields increasingly tenuous results after not. Screen grabCFO Dive.

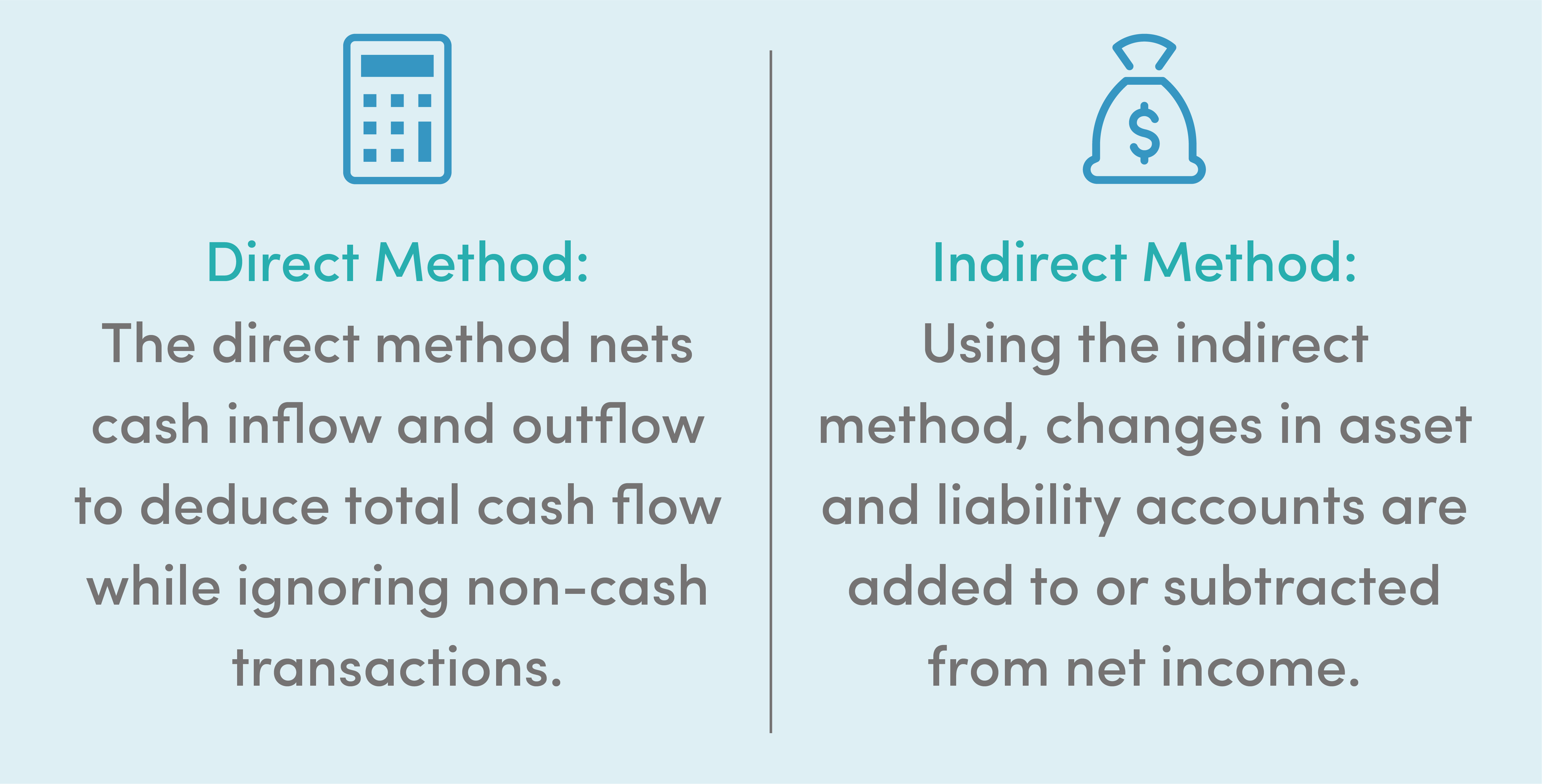

Because of the importance of an accurate cash picture CFOs and treasurers typically rely at least informally on whats known as direct cash flow. Direct cast flow forecasting is calculated by plugging in cash inflow and outflow directly. Direct forecasting can be quite accurate while.

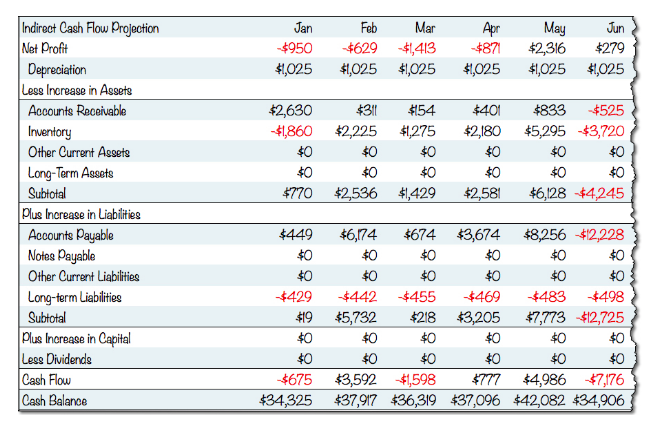

The indirect method is widely used by many businesses. Indirect forecasting works instead by taking the net income and adding or subtracting. Generally speaking the indirect method is easier to use.

This is an essential part of measuring day-to-day cash flows and knowing. So if the direct method is so accurate why would you use the indirect method. For both direct and indirect cash flow statement preparation you prepare the financing and investing portions in the same way.

Direct cash forecasting or short-term forecasting shows cash positions at a specific time. Generally companies start with direct cash flow forecasting to understand their daily cash movements. These are called the direct and indirect method of cash flow forecasting.

In fact its the only feasible way of. The direct and indirect methods of cash flow forecasting affect the cash from operating activities. Obviously the direct method for calculating the net cash flow is not only less time consuming when comparing direct vs indirect cash flow methods but also more informative.

While both are ways of calculating your net cash flow from operating activities the main distinction is the starting point and types of. The direct method on the other hand describes listing all your businesss cash inflows and outflows during the defined period. Indirect cash flow forecasting is a valid and often convenient method to look ahead at cash flow.

Statement of cash flows can be prepared and presented by two methods namely direct method and indirect method. The direct approach affects only the cash flow statements. The indirect method uses your net income as its base and comes to a figure by the use of adjustments.

Rated the 1 Accounting Solution. As a rule companies start out with direct cash flow forecasting to get an idea of daily movements. Indirect cash flow forecasting Expand All What is direct cash forecasting.

This one is about a very common alternative cash flow method called indirect which projects. This helps them to identify borrowing or investment opportunities. This then helps you identify your businesss net cash flow.

Ad QuickBooks Financial Software. The indirect method which is best for longer terms uses. Whereas the direct method will only focus on the cash transactions and.

It is a simple way of calculating your cash flow and can be done quickly from data readily available in your. The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses. As a rule companies start out with direct cash flow forecasting to get an idea of daily movements.

When reporting income this only takes into account money that has actually been received by the firm meaning it directly reflects the actual cash a company has to hand and. The key differences between the Direct vs Indirect Cash Flow Methods are as follows. The indirect method The indirect method of.

August 30 2021 Khayyam Javaid ACA.

2022 Cfa Level I Exam Cfa Study Preparation

Free Cash Flow Statement Templates Smartsheet Cash Flow Statement Spreadsheet Template Cash Flow

Direct Vs Indirect The Best Cash Flow Method Vena

Ias 7 Statement Of Cash Flow Summary Video Lecture Acca Online Accounting Teacher Positive Cash Flow Cash Flow Accounting Jobs

Differences Between Direct And Indirect Cash Forecasting Cashanalytics

Printable Free Cash Flow Forecast Templates Smartsheet Cost Forecasting Template Pdf Cash Flow Budget Forecasting Personal Finance Budget

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Cash Flows Operating Activities Direct Vs Indirect Method Accounting Financial Tax

Direct Vs Indirect Cash Flow Statement Excel Model 365 Financial Analyst

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

How Direct Cash Flow Models Help Predict Liquidity Wsj

Differences Between Direct And Indirect Cash Forecasting Cashanalytics

Direct And Indirect Cash Flow Statement Comparison Cash Flow Statement Cash Flow Positive Cash Flow

The Direct And The Indirect Method For The Statement Of Cash Flows Online Accounting